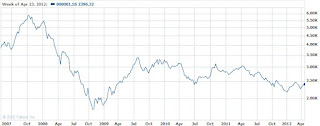

In 2011, the benchmark Shanghai Composite Index tumbled by -21.7% YoY to 2199 at the end of the year. It was also a 9% deviation from our own target of 2417, although the direction (downward) was accurately predicted.

We, Mr China, now announce our own Shanghai benchmark SSE Composite Index target as 2358 in 2012, a +4.9% rebound from 2199 since end-2011. If we predict this trend accurately (again), it will be the first annual SSE rebound since 2009.

Our independent Chinese stock market expert team predicted fair values of various SSE industry weightings and put them into the SSE Composite Index formula. By calculations of our expert team, Shanghai benchmark SSE Composite Index target shall be 2358 in 2012. Key assumptions of our prediction are:

(i) Inflation pressure will be relatively stable in 2012. Reference: our 2012 China CPI target.

(ii) In 2012, there will be a slow-down in Chinese economy growth rate, although theoretically growth rate at +8% YoY should still be considered high. Reference: our 2012 China GDP target.

(iii) In accordance with our historical statistics, there is a high 80% probability that annual trend of SSE Composite Index should follow the direction of its performance in the starting month (January) of the year. Since SSE monthly performance was positive in January 2012 (up +4% from 2199 to close at 2293), it should be highly possible that 2012 SSE Composite Index will continue this upward trend likewise by the end of this year.

(iv) Non-freefloat shares being unleashed will still be an issue that affects the performance of China A-share market. Reference: Unleashing Non-freeFloat Shares Annoys A-share Market.

Based on our own rating system, the existing SSE Composite Index level of 2396 (as of end-April) shall be rated as "reasonable".

With PRC administrative tightening policy, although we predict that there will be a rebound in 2012 Shanghai stock market, we expect such market rebound will only be +4.9% YoY and will not too strong. Honestly speaking, current market situation is still quite unclear, especially because of external economic factors in Europe, U.S. or even Asia region. As Chinese central government is constantly making new changes to cope with these external economic factors as well as domestic volatile markets, it does require some more efforts for general investors to digest these policy changes being made in recent months. As you may also know, some policy changes in PRC are not quite easily understandable, particularly for most foreign investors, mainly because there are no similar economic policies elsewhere except PRC. Therefore, it might be difficult for them to digest these Chinese economic policies completely and predict any possible outcomes accordingly. However, these economic policies are usually so important and many of them can affect Shanghai stock market extensively. We, Mr China, will definitely continue to analyze these policy changes and will share our related important findings with you in this blog.

For this reason, the 2358 target value should only be considered as our preliminary release for 2012 Shanghai benchmark SSE Composite Index. We will closely monitor A-share market situations and can downgrade/upgrade our Shanghai SSE Composite Index target at a later stage if the valuation of the SSE stock constituents would change.

More Article(s) regarding our China Index Targets:

Table of All Our Released Targets for China

0 Comments:

Post a Comment